In a sea of red, DigixDAO is solid gold

There's blood in the streets in cryptocurrency right now, but it's not the blood of DigixDAO.

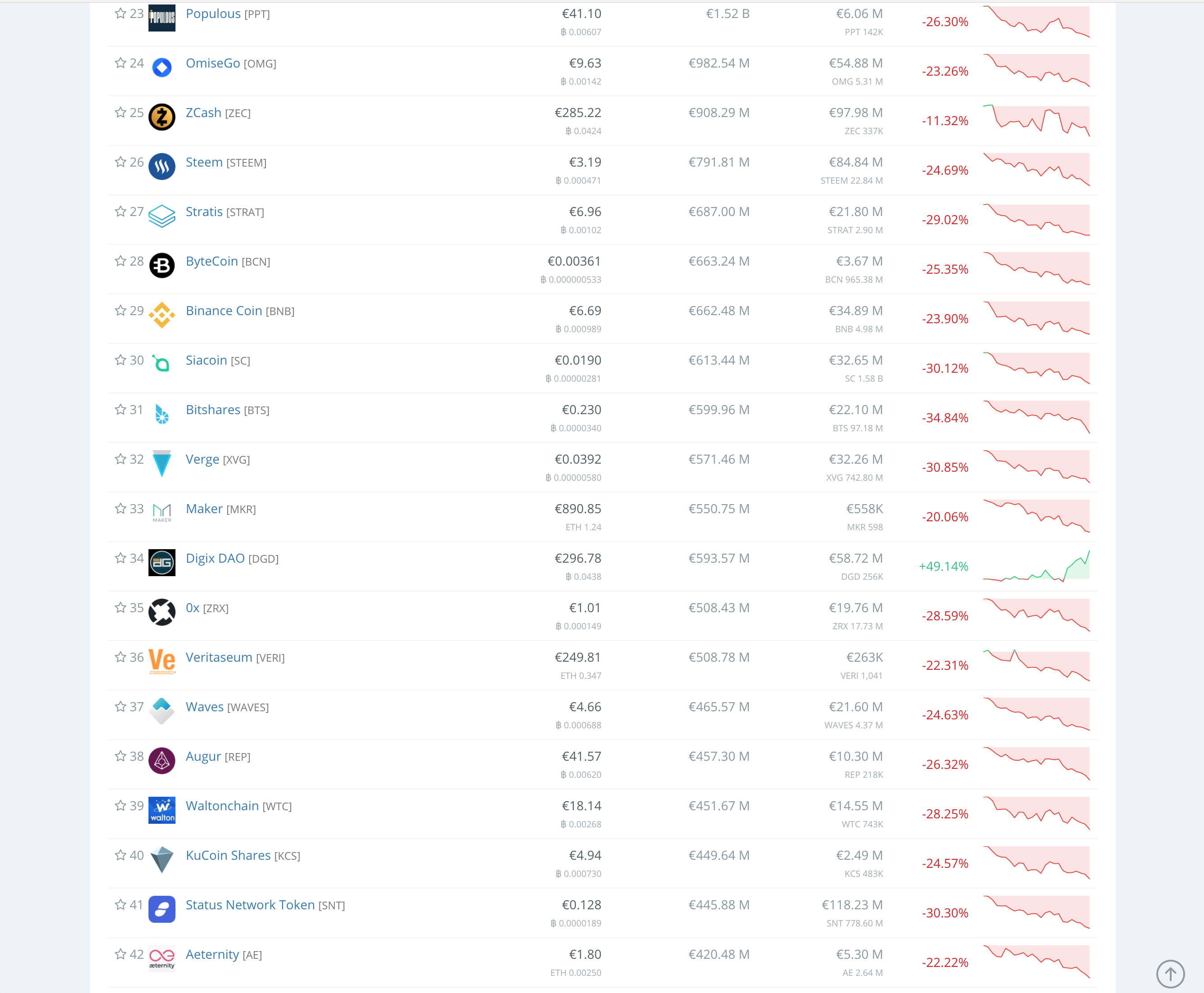

January hasn't been a great month for cryptocurrency investors and February is now looking equally dull with the market going much deeper into the shades of red. Except one token appears to be driving and that's the token that I recommended some time ago. Take a look at the market right now:

What's going on here? Well, as I covered before, DGD is the token that is essentially an investment in the upcoming Digix 2.0 marketplace and more importantly, the new token DGX. The new token DGX will be tied to gold and holders of DGD will receive rewards based on the fees from transactions taking place on the Digix marketplace, as well as demurrage fees. This is not a dividend as you must vote and participate in the DigixDAO system with your DGD tokens, so it is not passive income and is not regarded as a dividend.

This is all being done through decentralised smart contracts on the Ethereum blockchain. Just recently, at the start of January, Digix had a code freeze. This is big news, it means that they are gearing up to release the long awaited DGX token. They also just announced that they are parterning with MarkerDAO who are creating another token tied to USD. Why would anyone want stable cryptocurrencies though, what's the point?

When cryptocurrencies have deep losses, the ability for investors to avoid their losses by going into a more stable investment while they wait out the storm is limited. They have to hold it on an exchange or else transfer it to their bank. If they hold it on an exchange, they risk the exchange being hacked and they lose all of their money. If they transfer it to the bank, they risk missing out on gains when cryptocurrency recovers since it can happen so fast and generally getting fiat currency into cryptocurrency can be a slow process, and an expensive one when you include exchange fees. With the advent of "stablecoins", coins that are tied to much more stable assets like gold and USD, investors will be able to dump all of their portfolio into a stablecoin almost instantly, then wade out the storm, then when cryptocurrency starts recovering they can immediately buy back in again. They can hold these DGX tokens in their personal wallet, so there is no risk of them being stolen like if you held your money on an exchange. What does this mean for DGD token holders?

As pointed out before, DGD token holders will receieve dividends from the transactions taking place on the Digix 2.0 marketplace. It means that DGD is going to be a great token to own, even in the dreadful sea of red. In fact, during that period it may be the best token to own, because so many people will be panicking and moving all of their portfolio into any stablecoin they can get their hands on. All of those people will pay small transaction fees on the Digix 2.0 marketplace to acquire DGX and in future more stablecoins. These fees will go to you, the DGD holder. That's right, I'm saying DGD actually will have more value when the cryptocurrency is tanking and investors are starting to recognise this with the release of the long-awaited marketplace on the horizon.

In the face of fear, uncertainty and doubt, DGD thrives.